Invoicing is one of the fundamental aspects that businesses can’t function without. After all, you need to get paid for the product or service you sold. Most small business owners and entrepreneurs don’t think about automated invoicing and billing software simply because they don’t feel the need.

However, as the business scales and you need to produce recurring invoices for the same clients, the task becomes strenuous. Businesses end up spending way too much time and other resources on non-revenue-generating tasks.

Thankfully, invoicing software is here. Whether you see it as accounting software or billing software, it typically serves the same purposes. Interestingly, these “purposes” include a lot more use cases than you may think. I’m writing this post to share the wonders of the best invoicing software.

What is an Invoicing/Billing Software?

Before I start dabbling into invoicing software options, a brief introduction is due. Generally, invoicing software is a tool that allows various business models to deploy automated invoicing systems to streamline the overall operation.

One of the primary benefits of billing software is that you can create a list of services and products along with their prices when you set up the invoicing solution. Most tools offer plenty of invoicing templates to accelerate the billing process as well.

Thanks to these tools, you can send invoices to all of your clients that appear professional without spending hours. As a result, it improves cash flow for small businesses, allowing them to grow their bottom line.

High-end invoicing software not only allows you to generate invoices but also to send invoices, accept online payments, schedule recurring invoices, and set automatic payment reminders.

What’s even more interesting is that some of the accounting tools offer integration with payment gateways or inventory-tracking software tools to bring your business systems under a common umbrella.

Types of Invoice Software

Depending on your monthly estimated revenue and ROI, you get to choose from different software types when it comes to invoicing. Here are the commonly used models by small businesses as well as enterprises.

Online/Cloud-Based Solutions

From what I’ve seen, this is the most commonly used model for invoicing. Cloud-based tools require no hardware capabilities on the client end and follow a subscription billing model, making the onboarding process a walk in the park for businesses.

Another excellent perk of online invoicing processes is that everything is centrally stored and managed. You and everyone else with access to the billing software can see the changes in real-time. As everything is stored in cloud servers that feature redundant storage systems, your data is typically safe.

In most cases, cloud-based software also offers mobile apps to ensure connectivity across the board. It doesn’t matter whether you’re at the office or in a remote corner of the world, you can trigger the billing operations seamlessly. Even if you don’t have internet access, you can expect the invoicing platform to sync the actions once you connect.

Last but not least, cloud-based billing and invoicing systems allow you to generate automatic reports to track invoices, monitor accounts receivable, and collect payments on time.

Offline/On-Premise Software

This is similar to other software or apps we use on our computers and smartphones. The invoicing solution is installed on local devices with no connection to the internet. While it’s a great option to safeguard confidential invoices, it suffers from a lack of seamlessness.

For example, every time you create invoices, you also have to update it somewhere else, on a spreadsheet, perhaps. The same goes when you receive payments. While this is not manual invoicing by definition, you’re doing most of the tasks manually, defeating the purpose of billing software in the first place.

Needless to say, you’re more susceptible to errors in the process. For example, you might forget to update unpaid invoices, hurting the cash flow of your business. You’re also missing out on the reporting feature that can help you identify inefficiencies in the system.

I’m not saying these are bad choices. I’m just stating the facts. If you run a business large enough that you need advanced billing features that no other software offers or you want to keep the documents away from the internet, go ahead and invest in an on-premise tool by all means.

Invoicing Software Potential: Tap into Your Business Dynamic

Invoicing software can change how you operate in the long run. As I already said, such software solutions can do way more than you would think. In this section, let me outline the benefits of using the best invoicing software.

Saves Time & Money

We all know the saying “Time is Money”. It’s true across all business models simply because most businesses pay their employees by billable hours and use the same model to charge clients. At the same time, manual processing slows the entire process down and increases the chance of late payments. You’re not only spending time on tasks that don’t add to the bottom line but also getting paid late.

So, if you can reduce the time and effort that goes into the invoicing process, you can save a hefty chunk of money. An online invoicing software pretty much eliminates the need for an accounts payable department.

Increases Accuracy

Accuracy is critical in billing processes. One simple error can lead to serious consequences if your business gets audited by authorities. There are numerous examples of companies paying hefty fines because the accountant put a decimal in the wrong place.

Using automated software for billing and invoicing can eliminate the chances of errors. Of course, errors can still occur if the software is not set up properly. But the chances are slim.

I highly recommend that you carefully list the products/services and their corresponding prices when you first deploy the system. Be sure to double-check everything before leaving the tool on autopilot.

Enhances Cash Flow Management

By definition, cash flow refers to the net cash or cash equivalents transferred in and out of a company. It’s critical for small businesses because their inventory management may depend on it. Late payments or missed payments can wreak havoc on a business’s finances.

But when you use software for creating invoices as well as collecting payments, you minimize the potential for delays. If you accept payments online, you get to streamline the flow of cash even more!

Better Customer Experience

It doesn’t matter if you own an e-commerce business or a service-based business. Customer experience will always be the primary trigger for success. The happier your customers are, the sooner they’ll come back.

Believe it or not, custom invoices can help you improve customer experience! It not only accelerates the process but also projects a professional image in their minds. Every time you send automated recurring invoices on time following the same invoice templates, it shows your customers that you’re organized and punctual, qualities that trigger trust among humans!

Access To Financial Data with Reports

It’s critical for businesses to track payments as well as expenses as they have to report to the authorities for tax purposes. Usually, it’s the accounting department that manages the generates and processes reports. For large businesses, there is no alternative to this but small businesses may get away with the best billing software in the market.

Most billing software solutions offer reporting features and you can generate them on command. You may or may not get to set the parameters you want included in the reports. From what I’ve seen, reports generated by invoicing software are quite comprehensive and include all major fields users may want to know.

Better Security and Compliance

I know invoicing and security don’t go hand in hand, at least not for the average user. Compliance, on the other hand, refers to business practices being aligned with government regulations.

Electronic invoicing is gradually becoming the norm thanks to its added security features and compliance.

When sellers send invoices manually, it’s possible for bad actors to intercept them and change the conditions to their benefit. The same is true for the client side. An accounting software, however, only allows edit access to administrators and authorized users. It means no one besides the permission holders can edit the invoices, adding an extra security layer.

The electronic model has convinced many countries around the world to mandate them in the business process. Australia, for example, mandated all agencies to use billing software since July 2022.

Improves Collaboration

This may not be the case for all billing software but the best invoicing software will surely offer collaboration tools. By collaboration, I mean the option to communicate with the people involved in the process. The business manager may need to convey a note to the accountant and it’s possible to do it via the billing solution.

Even if the invoicing software doesn’t offer collaboration tools by default, you can expect integration options for popular tools such as Slack, Trello, or Asana.

Collaboration also happens to be critical for inventory management. More often than not, you have an ongoing relationship with your suppliers and partners which also means you send recurring invoices to receive recurring payments.

In most cases, you get to automate the billing process by integrating the billing software into your inventory management software. The customized invoices are automatically sent to predetermined recipients and the online payments are credited to your bank account. At least, this is the gist of the process.

It’s Scalable

If you consider yourself an ambitious business owner, there is no alternative to the best invoicing software for you. It’s simply because as you grow the business, you won’t be able to keep up with unpaid invoices. They’ll pile up and hurt your growth.

But when you introduce a billing and invoicing system into the mix, you eliminate the elbow grease from the equation. It doesn’t matter whether you have 10 clients, 100 clients, or 1,000 clients. You can send professional invoices to all in due time thanks to the best billing software.

Additional Features to Utilize During Billing and Invoicing Processes

As I already said, the best invoicing software allows you to perform more tasks than just creating invoices. Here are some examples of features that you should look out for when investing in such a tool.

Automated and Customized Invoices

You already know about the templates. Most billing software will also allow you to match invoices based on input data. This eliminates the possibility of human error during data entry. In other words, the automated invoices will only be generated when all the fields match your preset conditions.

Not only that but you can also schedule these invoices to go out to selected clients. This way, you never have to worry about processing manual invoices.

Encrypted Billing

As modern invoicing tools allow users to integrate payment gateways, it’s critical to protect the financial details of all involved parties. You surely don’t want your client’s bank account details to leak, do you?

Thankfully, invoicing software that allows you to accept payments will also encrypt the billing information to keep data safe. In fact, it’s required by law to encrypt billing information where it applies.

If you’re using a tool that includes billing clients directly, chances are high that your client has connected their ACH bank transfer details or credit card details. While you’re accelerating the billing process by charging them directly, it’s crucial to protect the sensitive details from data breaches. Again, the encryption feature comes to help.

Apart from the encryption during transactions, these solutions allow you to create unique passwords or access codes to prevent unauthorized access.

Easier Payment Tracking

Sure, sending invoices and receiving payments sound nice. But what about payment tracking? Well, you’re in luck because most billing software includes the tracking feature. All parties of a particular transaction can monitor when their money is when they accept payments online.

This is an excellent feature because you don’t have to wonder whether the client has released your payment or not. I understand how awkward it is to ask when to accept the payment. With the best billing software, you’re always on top of the transactions while also focusing on more important business matters.

Customized Reports

I’ve hinted at the reporting capabilities of billing software multiple times in this post. Reports are essential to monitor business health as well as to derive actionable plans to improve efficiency.

In most cases, the billing solution you choose will offer customizable reports. The “customization” aspect refers to your ability to control what you want in the report. For example, you may generate reports for daily, weekly, or monthly transactions. You also get to set parameters for expense tracking.

Multiple Customer Accounts

Remember how I said invoicing software is scalable? To truly enjoy this feature, you need access to customer accounts in an organized way. That’s exactly what you get from modern-day billing software.

When you set up the tool, you should find the option to add customer accounts along with all the necessary details. In many cases, you may even find the option to integrate the invoicing tool into project management tools! This way, you can trigger payment requests for different projects from the same dashboard. The same goes for time-tracking software because you get to curate invoices for hours spent on the projects.

Speaking of dashboards, all billing software offers a standard dashboard for navigation and monitoring. You can expect a visual representation of all the paid and unpaid invoices to take the necessary steps.

Impeccable Customer Support

I know this is not a core feature of accounting software but I still want you to pay attention. You’re dealing with a lot of money and it’s important to have a backup plan. After all, cloud-based solutions to track invoices paid or unpaid can suffer from technical issues such as bugs and glitches.

If a payment request fails or the software is not working as it should, you need a portal where you can reach out and seek assistance. That’s where the customer support aspect of these tools comes into play.

My experience with the software has always been good. Then again, I’ve always been careful when choosing my software stack. I was extra careful to ensure good customer support and I urge you to do the same.

In this post, I’ll share my top picks for billing software. Note that all of them offer 24/7 support via multiple channels to keep your worries at bay.

Top 5 Invoicing Software

I can’t leave you hanging after explaining what modern account software can do to help you grow a business. So, I have gathered my favorite invoicing and billing software based on my experience. Check them out.

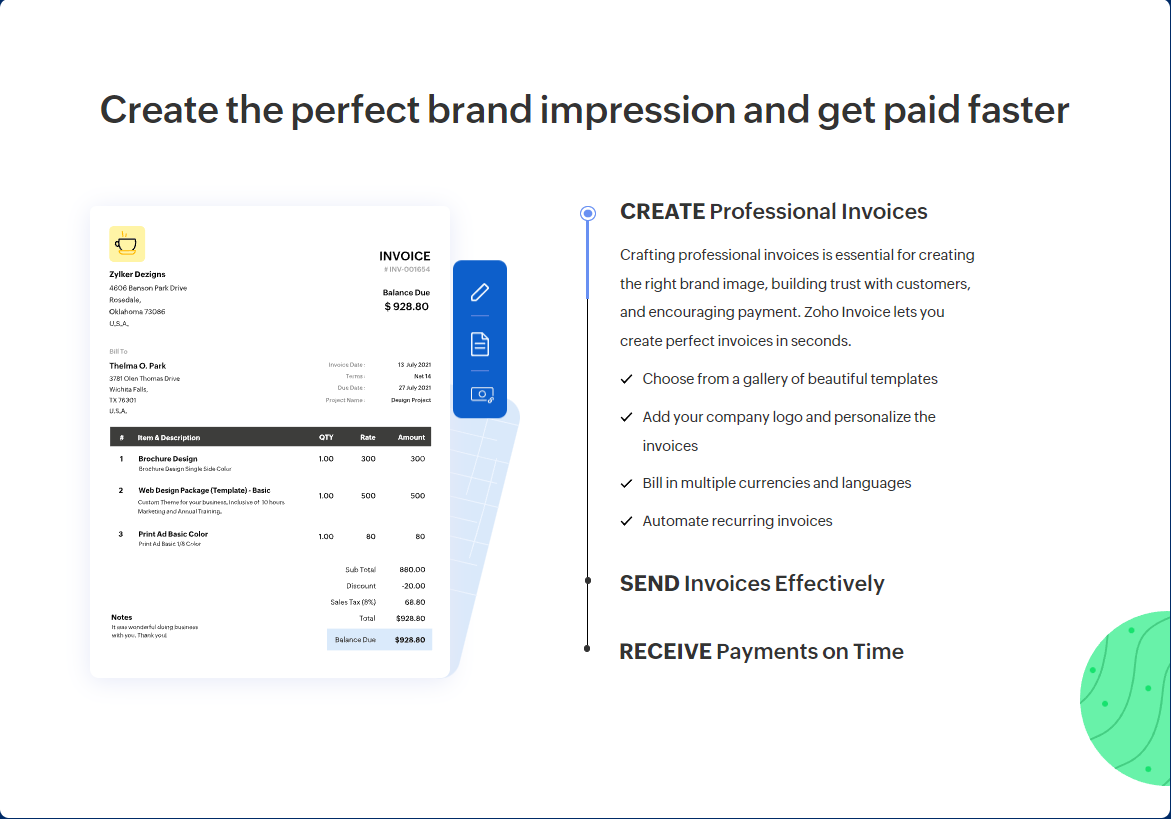

Zoho Invoice

Zoho is a reputable billing and invoicing software that’s been in operation since 2008. It’s one of the pioneers in automation. If you own a small business, Zoho Invoice might be the perfect tool for you to process recurring invoices, send payment reminders, and track all of your expenses.

Interestingly, Zoho Invoice includes an integrated time-tracker to log hours and translate the data for invoicing.

Zoho Invoice allows you to send bills via a multitude of channels. You may use SMS, email, or the integrated customer portal. Of course, it includes popular payment gateways such as credit cards, ACH bank transfers, and digital checks.

In recognition of its impeccable services, Zoho Invoice has its own awards such as Software Suggest Best Support 2021, FinancesOnline Expert’s Choice 2020, and G2 Lead in Small Business.

The tool is preferred by individuals and business owners all over the world and across industries. From freelancers to LLC businesses to taxi services to musicians, everyone can benefit from Zoho Invoice!

Do you know what the best thing about this billing software is? The fact that it’s completely free! Yet, it promises to never compromise your or your client’s data. The platform features bank-grade encryption.

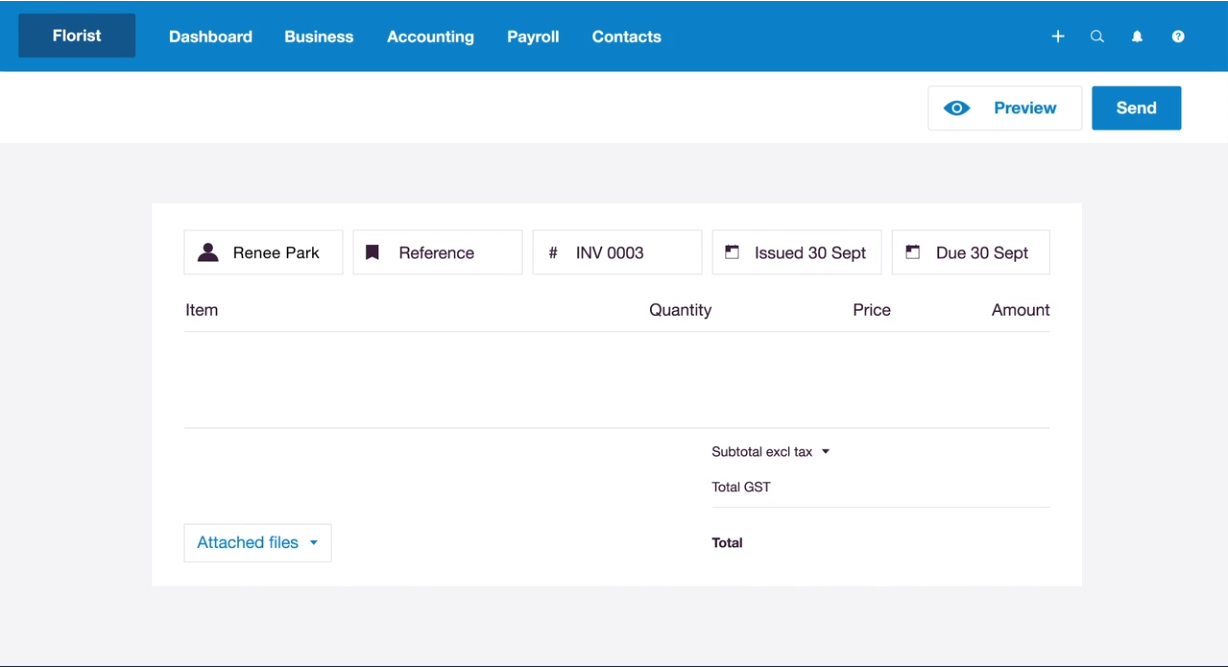

Xero

Xero offers a powerful solution to your invoicing needs with its online accounting software. This cloud-based billing solution is available across desktops and mobile devices. Xero claims to be an “intuitive” invoicing and billing software and I have to agree. I had no trouble finding the features to generate invoices for my clients.

Apart from the offered templates, you’re free to create your own if you feel the need. You get to add as many fields as you need on your invoices before sending them out. Of course, you can send quotes to potential clients as well using the same formula. The best part is that you can convert accepted quotes into invoices in a few clicks!

Besides sending invoices, you can also set automatic payment reminders. Once the clients get notified, they can pay with only one click if you add the option to your deliverables. Xero is compatible with regular credit and debit cards as well as direct bank debit.

Another great feature is the bulk import. If you’ve been using a different invoicing tool and you want to bring them to Xero, you can do it with a simple CSV file.

In terms of cost, Xero is quite affordable. Plans start from $13/month (Early) which allows you to send up to 20 quotes and invoices. If you want unlimited invoices, I recommend Growing or Established plans.

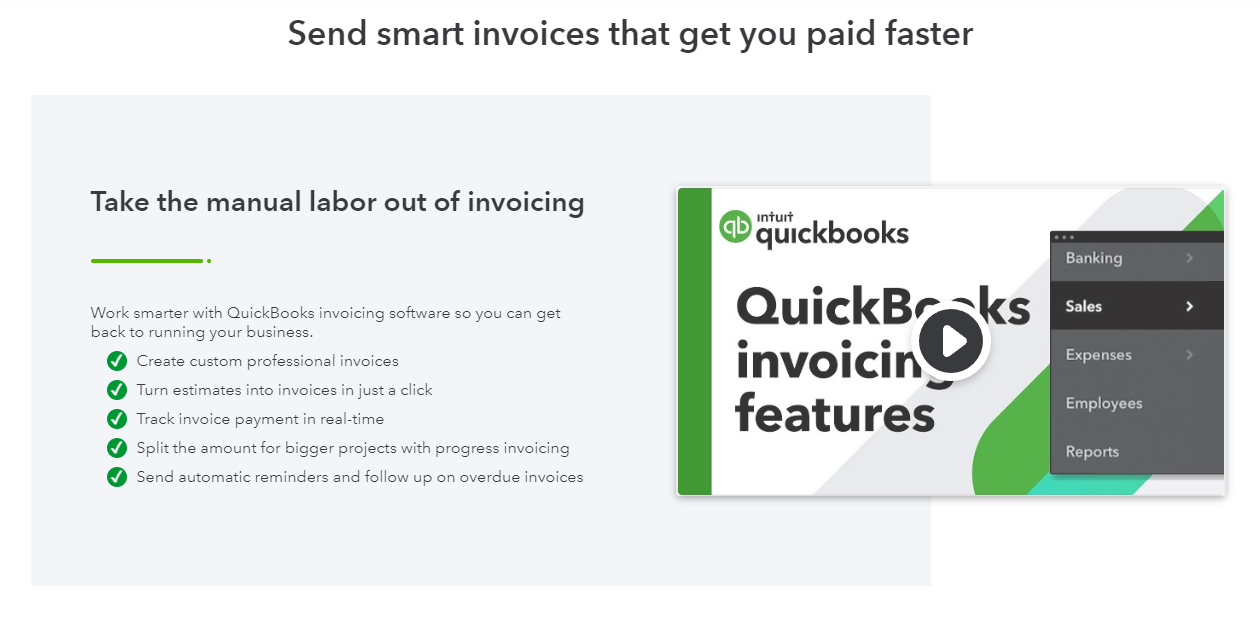

QuickBooks Online

QuickBooks need no introduction when it comes to accounting. It’s been around since 1983, making it a veteran in the world of digital invoicing. It’s one of the most comprehensive tools out there for business accounting.

The billing and invoicing software allows users to create custom quotes and invoices. Of course, you have templates that you can use too. But I recommend crafting your own simply because you want your invoices to look professional. The customization features offer pretty much everything you need to make your invoices appear in line with your branding.

Similar to Zero, QuickBooks Online also allows you to convert quotes into bills with just one click. The dashboard includes expense tracking as well as payment status monitoring to keep you worry-free. The dashback is also packed with visualized data that you can see as bar graphs or pie charts.

Pricing for QuickBooks starts at 18/month for the “Simple Start” package. You can scale to “Essentials” for $27/month or “Plus” for $38/month. For most businesses, the Essential package is good enough. It includes all the basic features such as invoicing, reporting, expense tracking, VAT tracking, and so on. The upgraded packages are required if you want to accept payments in multiple currencies.

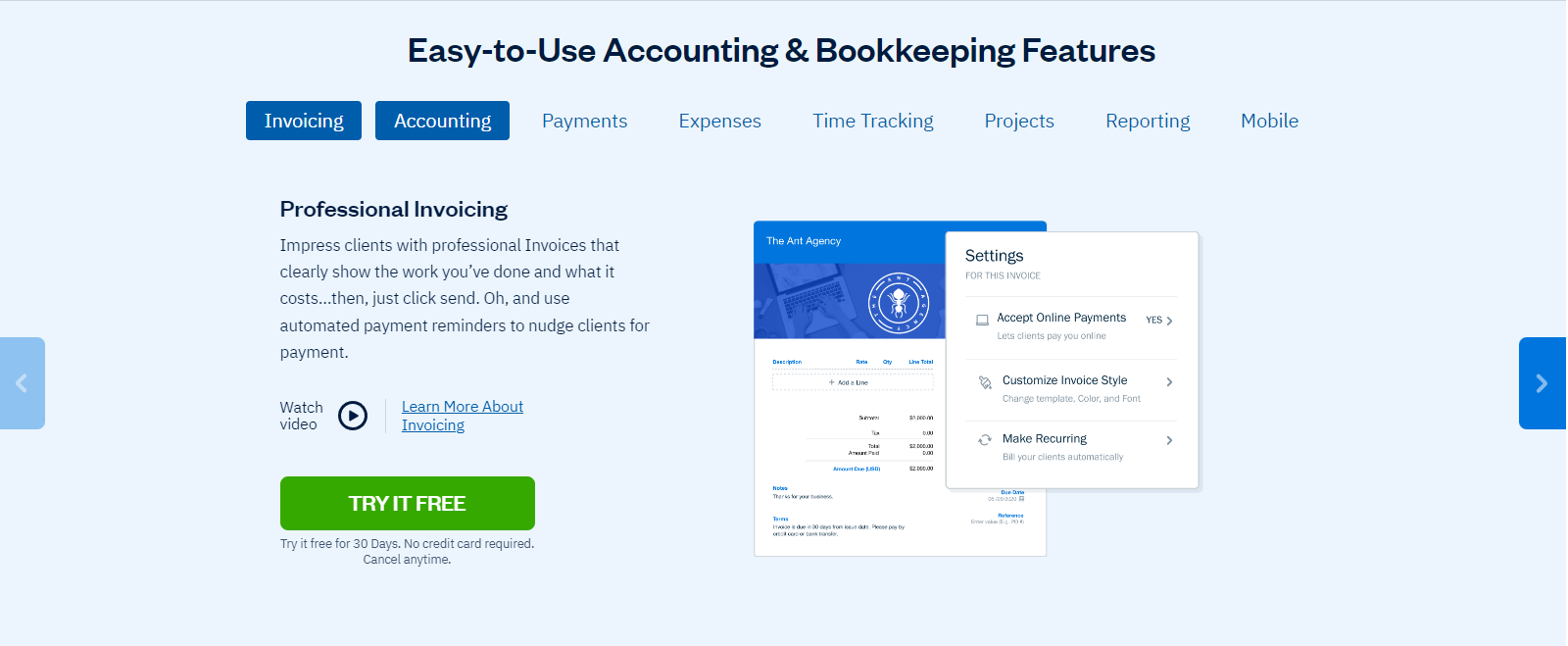

Freshbooks

QuickBooks and FreshBooks are strong competitors in the digital space although FreshBooks launched 20 years after QuickBooks. My experience has been excellent with FreshBooks simply because the invoicing and billing software is targeted at small businesses.

The invoice generator allows you to create professional invoices that align with your branding vision. The payment feature enables you to receive payments from clients sent via traditional banking channels. It also includes a time-tracker to track employee times or to calculate billable hours to include in the invoices. Similar to QuickBooks, FreshBooks accepts multiple currencies for payments too!

Apart from billing and managing payments, FreshBooks also includes project management features to help you form better client relationships. The notifications are one of the best features in my opinion because they keep you updated on the payment status at all times. The mobile app helps with connecting to clients no matter where in the world you are.

FreshBooks implements a 256-bit SSL encryption to protect the billing and payment data for both you and the client. The comprehensive reporting features help you track project status, especially if you’re working on a milestone-based model.

I find FreshBooks one of the most affordable billing and invoicing software out there. The Lite plan starts at 17/month. The most you can spend is $55/month with the Premier plan. But the provider mostly runs promotions so you may get a 50% discount from time to time. Also, there is a free trial for you to test the features before you invest.

Invoicera

In case you’re interested in billing software that also handles your inventory, it doesn’t get any better than Invoicera. It’s an excellent automation tool that features 3-layer security, custom workflow management, and in-depth invoicing.

The cloud-based solution might be the missing link in your business to accelerate growth and improve the bottom line. The use cases are primarily favored by industries that require elaborate inventory management such as hotels, restaurants, and super shops. The inventory data can then be transferred into invoices automatically to bill the clients.

Invoicera claims to be the world’s most powerful online invoicing and billing software based on its automation capabilities. While I won’t entertain the claim to its fullest extent, I can’t deny that it’s an excellent invoice software for all business types. Especially with automation at large, Invoicera might be what you need to streamline your business processes.

The pricing for this software starts at $19/month and this plan allows up to 100 clients with 1 authorized staff. The “Business” plan is the middle ground that allows up to 10 staff and 1,000 clients for $49/month. You can also get the Enterprise ($99/month) or Infinite ($149/month) but I think these are overkill for most companies.

FAQ

What are the benefits of an invoicing system?

Deploying invoicing and billing software helps businesses keep track of their client accounts and payments without manual monitoring. Most tools include features like payment reminders, and an option to customize invoices and collect payments to eliminate the need for manual intervention.

Which software is best for making invoices?

You’ll need to decide what’s the best invoicing software for your business depending on what you need. I have shared my top 5 picks of account software that caters to businesses of all sizes. For an easier start, you can check out my mini-reviews and pick one.

What does invoicing software do?

An invoicing and billing software does exactly what you expect it to do and more. Of course, they generate unlimited invoices, send invoices to clients, and collect payments. Many tools include additional features such as time tracking and inventory management to help a small business cut overhead costs.

How much does invoicing software cost?

The cost for invoicing and billing software can vary quite dramatically depending on how many clients you want to manage and how many staff you want to assign to the tool. The pricing for subscription models can vary anywhere between $10 to $100 or more.

What is ERP billing software?

ERP stands for Enterprise Resource Management. As you’d expect, an ERP billing software is for enterprise businesses to process and maintain accurate invoices, manage inventory, report to authorities, and account expenses/income.